Simple Solutions to Complex Problems

Offering Subscription-Based Portfolio Management Newsletters

Providing a Simple and Effective Equity Solution to Our Subscriber Base

Investoristics, LLC represents over 25 years of experience studying the relationship between fundamentally sound stocks and those characteristics indicative of future performance. Investoristics is where sound fundamentals meet predictive metrics and statistics which results in Investoristics.

Market Insights

The Recession Is Coming, Should I Wait to Invest?

Historically, there has been a considerable debate among investors about whether it is better to wait until a recession is over before investing or to continue investing throughout the economic downturn. Even though history is a great guide to the future, it’s important to note that past performance is not indicative of future results, and…

Competition Is Good, If You Have The Right Investment Strategy

Competing investment strategies, even those not grounded in fundamentals, can create better investment opportunities for individuals who possess a well-thought-out strategy. While it may seem counterintuitive at first, the presence of different investment approaches introduces market inefficiencies and mispricings that astute investors can exploit. One of the primary reasons why competing investment strategies can…

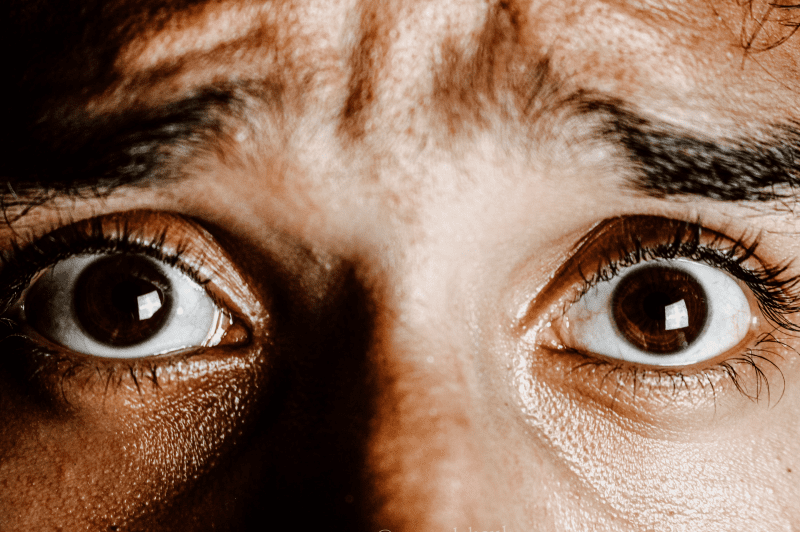

Don’t Be Afraid, Have A Plan

Fear of loss is a common psychological trait exhibited by many individuals, particularly when it comes to investing in the stock market. This phenomenon, known as loss aversion, can have a significant impact on investor behavior and decision-making. Research suggests that people tend to fear losing more than they appreciate winning, and this asymmetry in…

Current Challenges Facing Investors

Too many investors have strayed from the fundamentals when building investment portfolios which are typically fee-heavy and fail with regard to meeting desired performance goals. Many investors are not utilizing the best-performing investment strategies due to a lack of effective options.

Our Approach to Investing

Investoristics, LLC implements a model that exploits price inefficiencies in the market and identifies a select group of stocks that exhibit those characteristics that are indicative of future market outperformance.

Our proprietary ranking system picks stocks according to their overall potential for growth by selecting those stocks with the best combination of quality, value, and financial strength.

Investoristics, LLC operates under the assumption that a stock's price ultimately follows the underlying stock's earnings growth and expectations for future earnings growth. There are always a select group of stocks violating this principle, and holding a basket of stocks that violate this principle performs extremely well over time.

Our Approach to Investing

Investoristics, LLC implements a model that exploits price inefficiencies in the market and identifies a select group of stocks that exhibit those characteristics that are indicative of future market outperformance.

Our proprietary ranking system picks stocks according to their overall potential for growth by selecting those stocks with the best combination of quality, value, and financial strength.

Investoristics, LLC operates under the assumption that a stock's price ultimately follows the underlying stock's earnings growth and expectations for future earnings growth. There are always a select group of stocks violating this principle, and holding a basket of stocks that violate this principle performs extremely well over time.

Performance Expectations

Investoristics, LLC provides subscribers with a highly focused equity portfolio with consistent market-beating returns versus the S&P 500. Focused portfolios based on quality, value, and financial strength perform very well in all market cycles with significant outperformance against the S&P 500 while maintaining a lower risk profile.