Posts by Darryl H

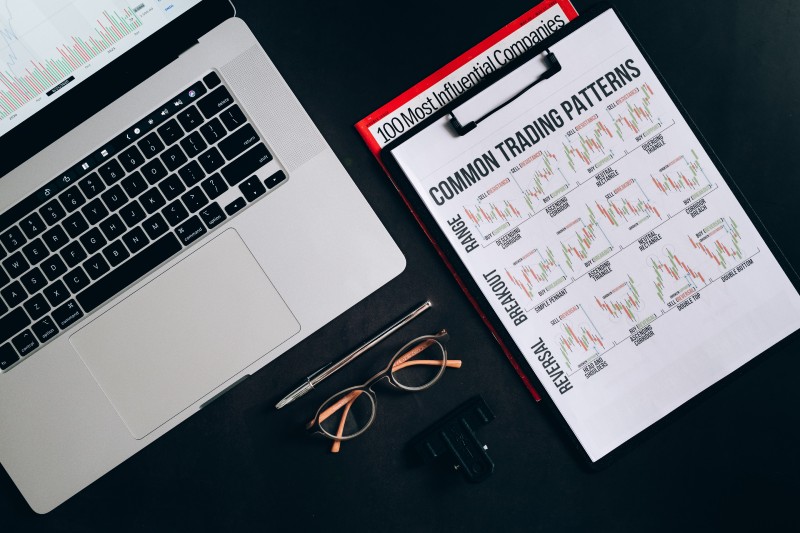

Buy Low, Sell High

The goal for any investor is to make money over time by investing in the stock market or any other market utilizing different approaches to accomplish their goals. Some investors seek to not just make money by accepting the market’s average rate of return but to exceed the market’s average return by as much as…

Read MoreDoes Your Investment Strategy Talk?

Depending on the type of investment analysis that an investor does, that analysis should give the investor an idea of where the value is in the market. Top-down investment approaches rely more on the investor’s ability to refine their investment approach or style to try to take advantage of where they believe there is value…

Read MoreWhere’s the Bottom?

As the markets continue to fall people are wondering when it all is going to end but unfortunately, there is no consensus opinion as to when the fall will end. As of the close of business on 5-17-2022 the Dow, S&P 500 and the NASDAQ were all down more than 10 percent since the start…

Read MoreThe Ultimate Long-Only Hedge Fund Strategy

The goal of any hedge fund is to invest in a variety of asset classes, from cash to cryptocurrency, in an effort to maximize returns and reduce risks. A hedge fund manager attempts to protect client assets by engaging in strategies that involve profiting in the securities markets whether the market goes up or down.…

Read MoreWhy Can’t You Outperform the Stock Market?

Warren Buffett, to paraphrase, once stated that he could earn about 50% annually if he only had a few million to invest. While few of us have millions sitting idly, there should be hope for us to at least beat the market. So, what is the problem? There is a lack of available options. Looking…

Read MoreTo Diversify or Not. That is the Question

Why the anger? Some people like focus while others do not. So, what exactly are the arguments for heavy diversification versus concentrated portfolios. To paraphrase two well-known investors – anybody who diversifies an investment portfolio must be an idiot or a moron. These statements can be attributed to billionaire entrepreneur and television personality, Mark Cuban…

Read MoreNever Go Broke, It Is Easy to Self-Annuitize

Whether you are super wealthy or just the average retiree, you might be concerned about outliving your current income or preserving your wealth. To avoid outliving your current retirement income, you first need to determine how much of your nest egg you need to invest to generate the amount of income you need over your…

Read MoreAn Investment Tug-of-War: What Is Best and What You Can Tolerate

Investors want both low volatility and the highest possible returns. Unfortunately, that option is not always available but not because there are no strategies but because of investor temperament. Choosing an investment strategy that is suitable for an individual investor is not as easy as it seems. Whether an investor manages his or her own…

Read MoreAlternative Investments, Do You Really Need Them?

Alternative investments are generally used by investors to diversify their investments beyond the typical asset classes of stocks, bonds, and cash. Alternative investments are usually private equity funds, private REITs, private real estate funds, hedge funds, or venture capital funds. The hope of diversifying with these alternative assets is to reduce volatility and increase your…

Read MoreA lifetime of Income from The Classic 60/40 Asset Allocation

In recent years financial pundits have declared that the 60/40 portfolio is officially dead and can no longer provide a stable stream of income from its component parts, 60% stocks and 40% bonds. The rationale behind declaring the death of this commonly used allocation is that bond yields are so low that allocating 40% of…

Read More