Archive for October 2023

Choose Wisely, Your Financial Future Depends On It

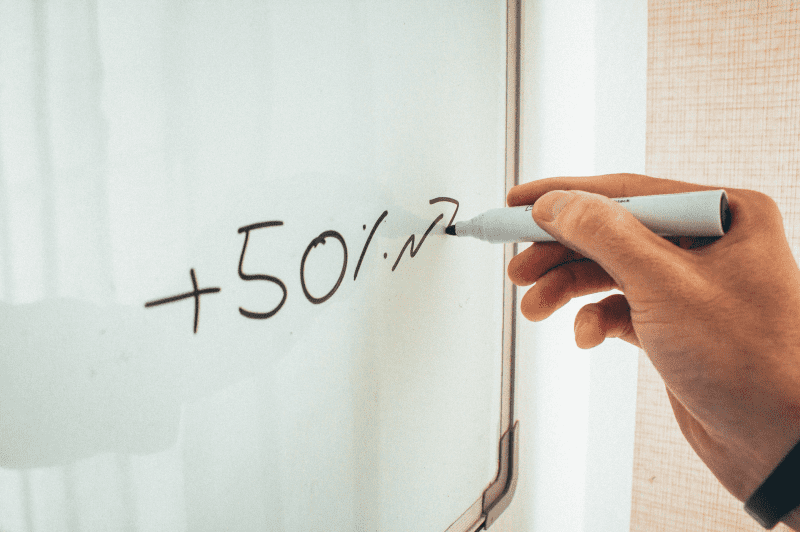

Investing wisely and achieving great returns is not solely dependent on in-depth knowledge of the stock market or the ability to predict market movements. Instead, it primarily hinges on the investor’s capacity to make informed choices and process information effectively. This fundamental ability empowers investors to navigate the complex world of finance, even without delving…

Read MoreShould You Revisit Your Backtest?

A backtested investment strategy rooted in consistent fundamental data holds immense validity and reliability in the world of finance. Unlike strategies based on fleeting market trends or speculative indicators, fundamental data remains constant over the years. This stability provides a solid foundation for backtesting, enabling investors to assess historical performance accurately. When a strategy is…

Read MoreMarket Volatility, Enemy or Friend?

Stock market volatility is a double-edged sword, capable of acting as both a formidable enemy and a valuable ally for investors. Understanding this duality is essential for navigating the complex world of investments. Volatility, essentially the degree of variation in trading prices over a certain period, can be your friend in several ways. For…

Read MoreDaily News Headlines and Your Investments

Allowing daily news headlines to influence your investment decisions can have detrimental effects on your investment returns over time. This phenomenon is rooted in the tendency of many investors to react impulsively to breaking news, believing that staying constantly updated will give them an edge in the market. However, this approach often leads to emotional…

Read More